30+ does a mortgage count as debt

Web Over 50. When the borrower owns mortgaged real estate the status of the property determines how the existing propertys PITIA must be.

How Much Debt Can I Have And Still Get A Mortgage

Find A Lender That Offers Great Service.

. Web Most of the amounts are manageable. Web Answer 1 of 25. Meanwhile any ratio above 43 is considered too high.

Web When a borrower is obligated on a mortgage debt regardless of whether or not the other party is making the monthly mortgage payments the referenced property. Reasons Why Mortgage is Counted as a Debt There are. This ratio is calculated.

Web Generally speaking a good debt-to-income ratio is anything less than or equal to 36. Web You might not think of your mortgage as a debt but you should realize that your mortgage should still be counted as one. Many lenders may even want to see a DTI thats closer to.

And to be honest we completely understand why they dont. 1500 on the credit card 4000 on your line of credit maybe 300 on an old phone bill and say 14000 on a car. Divide your total monthly debts as defined in Step 1 by your gross income as defined in Step 3.

Web Student loan debt is often considered in your DTI ratio a formula mortgage lenders use to help assess your creditworthiness as a borrower. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web Lenders usually look at your DTI ratio as a percentage.

Then you look at the last debt you have. Its a lot but its doable. Web Expressed as a percentage an income to income ratio is calculated by dividing the total recurring monthly debt by the gross monthly income.

Monthly debt obligationsdivided byMonthly incometimes100equals DTI For. Next determine your gross pre-tax. How Much Interest Can You Save By Increasing Your Mortgage Payment.

Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. 1 Add up the amount you pay each month for debt and recurring financial obligations such as credit cards car. Lots of homeowners do not consider their mortgages when they calculate their total debts.

Web To calculate your debt-to-income ratio start by adding up all of your recurring monthly debts. Compare More Than Just Rates. A debt-to-income ratio of 50 or higher tends to indicate that you have high levels of debt and are likely not financially ready to take on a mortgage loan.

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Web According to a breakdown from The Mortgage Reports a good debt-to-income ratio is 43 or less. You can calculate your DTI ratio by dividing your recurring minimum expenses by your total monthly income.

Web DTI measures your debts as a percentage of your income. Web Lenders calculate your debt-to-income ratio by using these steps. Thats your current debt-to-income ratio.

What income is needed for. To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments. To calculate your debt-to-income ratio first determine your gross monthly income.

Web Qualifying Considerations. Ad See how much house you can afford. Is my house an asset if.

Web Most mortgage lenders want your monthly debts to equal no more than 43 of your gross monthly income. Look into government-backed loans that may be more flexible. Web Divide Step 1 by Step 3.

Heres how lenders typically view DTI. This is your monthly income before taxes are taken out. Estimate your monthly mortgage payment.

Web Lenders consider student loan debt as a part of your total debt-to-income DTI ratio which is a vital indicator of whether youll be able to make your future. Beyond your mortgage other recurring debts to include are. In some cases its easier to qualify for government-backed loans even if you have a higher DTI.

Web Does mortgage count in debt-to-income ratio.

30 Mortgage Loan Officer Illustrations Royalty Free Vector Graphics Clip Art Istock Partnership House For Sale House Exterior

How Much Debt Can I Have When Buying A House Check Debt Limits

How Much Debt Can I Have When Buying A House Check Debt Limits

Student Loans Are Holding Back Millennials Who Want To Be Homebuyers

Home Loan Extra Repayment Calculator Cut Years From Your Mortgage

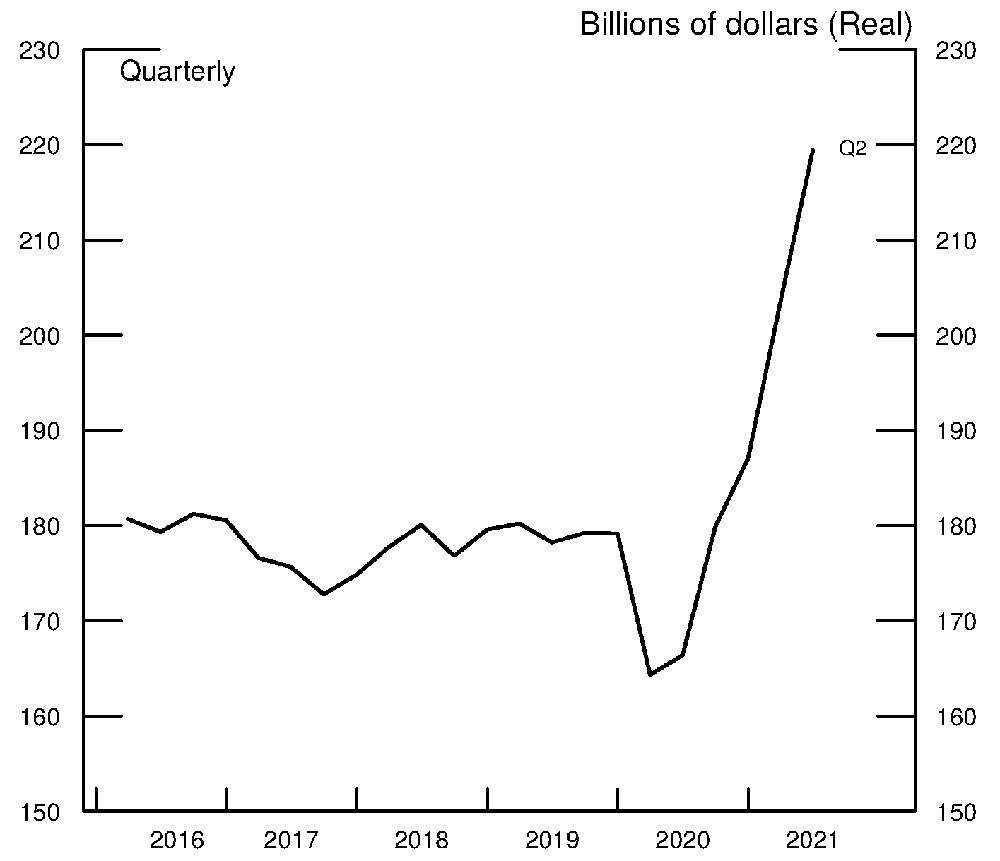

The Fed Delinquency Rates And The Missing Originations In The Auto Loan Market

Mortgage Guidelines On Late Payments In The Past 12 Months

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

All In One Loan Juan Stewart Jr Mortgage Loan Originator

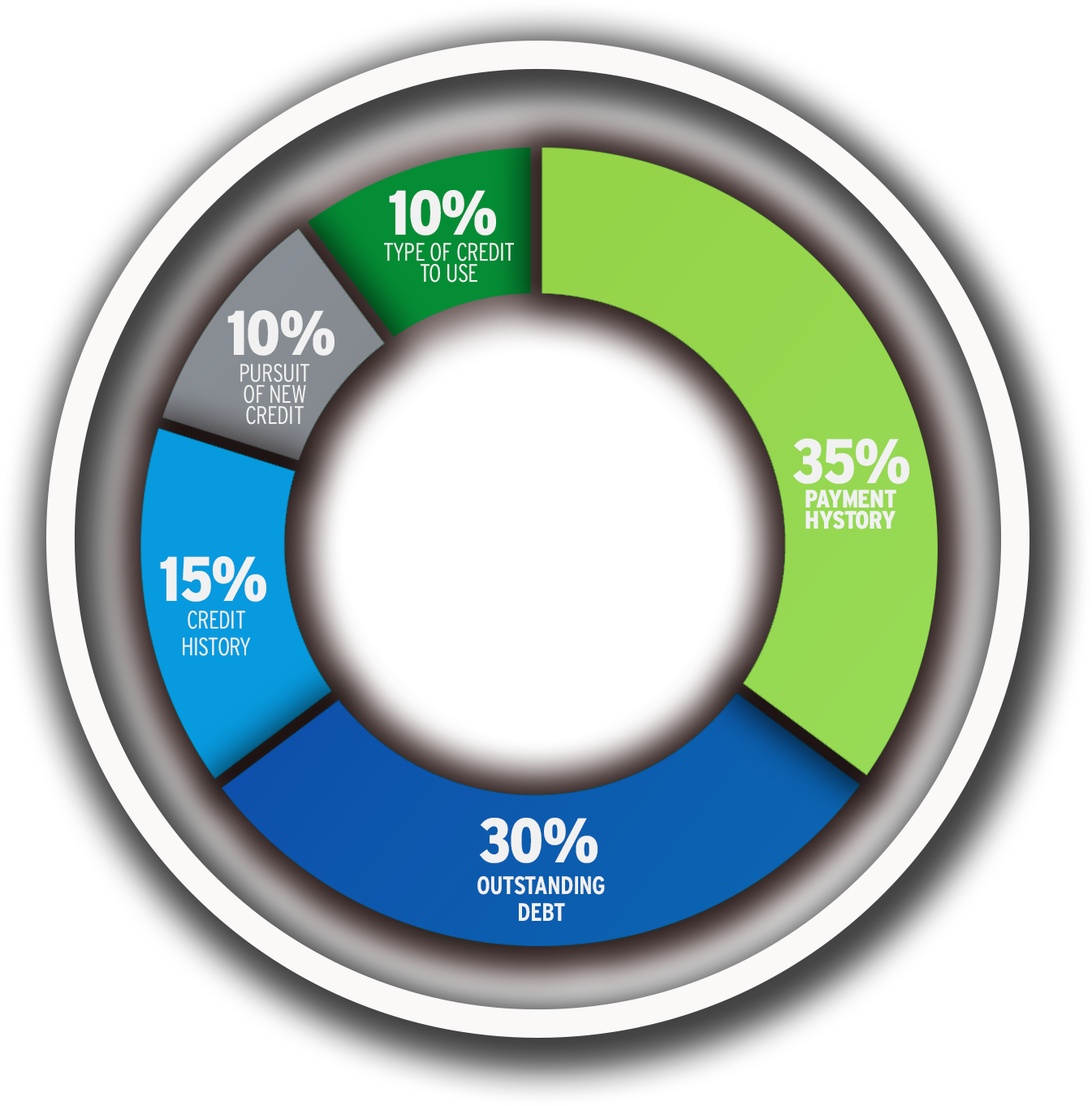

How Debt To Income Ratio Is Calculated American Credit Foundation

How To Improve Your Credit Score Eric Patterson Branch Manager

Using Home Equity And A Hard Money Loan For Debt Consolidation Sun Pacific Mortgage Real Estate Hard Money Loans In California

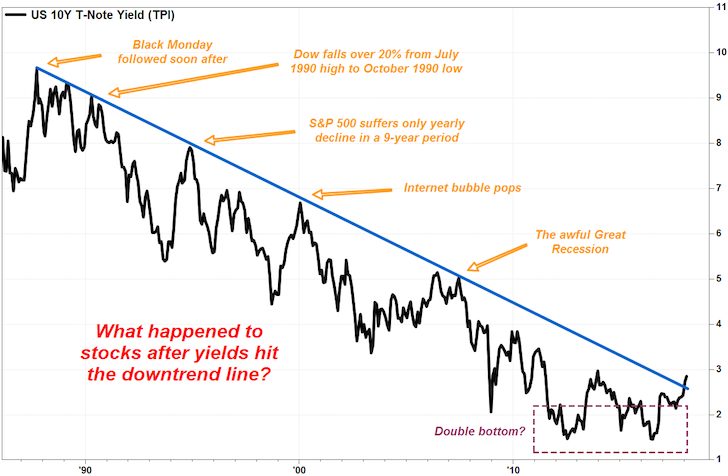

Mortgage Lender Woes Wolf Street

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

Does Hecs Debt Affect Your Home Loan And What To Do About It

What Is A Debt To Income Ratio Consumer Financial Protection Bureau

U S Mortgage Delinquency Rate 2000 2022 Statista